sample cover page

What is included?

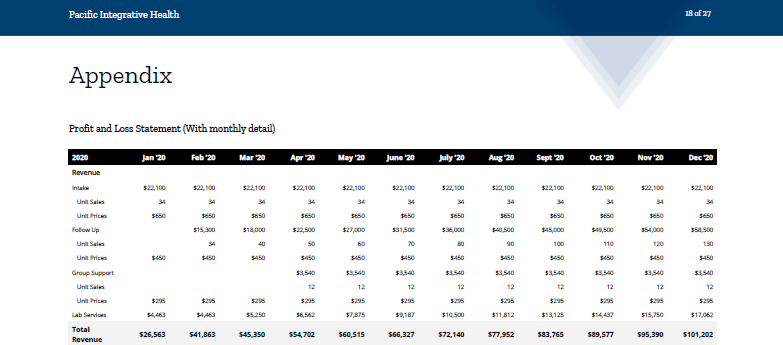

The plan includes 36 months of profit and loss, balance sheet, and cash flow projections, backed up by detailed written assumptions.

A comprehensive written portion describes the opportunity, the organization, a summary of the market and demographics, and a detailed exposition on the borrower’s directly applicable experience.

Also included is coaching prior to the borrower’s SBA interview to ensure they have maximum comfort using the document as a tool.

How much does it cost?

Prior to any fee, I consult with the client for 20-30 minutes to see if we’re a fit to work together.

For loans under $1mm, my fee is $1,800, representing a bulk of the work that I do.

For larger deals, my fees have been $2,450-$3,600, depending upon complexity and the quality of historical financials.

For strictly financial projections and assumptions, the fee is half, or in the range of $900-$1,800, again, depending on complexity.

Monthly profit and loss example

How long does it take?

Not long. I send the client a link to my business plan questionnaire, which can be completed by mobile and to which attachments may be uploaded.

My turnaround time is largely dependent on client response time, though I can provide a completed business plan in about 48 hours.

What else?

Some lenders have told me they copy and paste from my business plan directly into the credit memo. Tell me what you would like to see and I’ll make sure to include that in the plan.

I also work with underwriters on the client’s behalf if anything needs to be further clarified in the assumptions or the sales plan.

Which industries?

Basically anything, startup or expansion. A sampling of previous plans include:

Fro-Yo franchise

Indoor cycling franchise

Medical office startup

Brewery expansion

Ground up construction—self storage and RV/boat lot

$3mm veterinary acquisition

Indoor bounce house franchise purchase

$3mm industrial recycling plant acquisition (challenging borrower personal finance situation)

Beauty school building purchase and expansion

Residential rehabilitation facility

Medical day spa

Loan brokerage

Private investigation firm

Ground-up warehouse construction-marine manufacturing

Promotional product franchise

College town bar startup

Industrial project management firm (in Texas, financials only)

Nightclub startup

Dental practice purchase

Daycare

And many more!