For example, many believe the SBA provides direct loans to small businesses, but in fact lenders like banks, credit unions and other financial institutions provide the loans, while the SBA provides a guarantee.

Read MoreWhy Financial Projections Make Your Business Plan Fly→

/A well-crafted business plan is essential for any small business owner aiming to turn their vision into reality. At the heart of this plan lies a critical element that can make it soar…

Read MoreCommon Business Planning Mistakes

/Creating a well-crafted business plan is a crucial step for any entrepreneur or business owner looking to lay the foundation for success. Here are 8 common business planning mistakes and actionable insights on how to avoid them.

Read MoreTypes of Small Business Loans and Qualification Tips

/Understanding the different types of business loans available and the qualifications required can significantly enhance your chances of obtaining the right financing.

Read MoreWriting a Winning Business Acquisition Plan

/Navigating the complex world of business acquisitions, imagine the process as meticulously piecing together a puzzle where each piece symbolizes a critical component of a broader, strategic vision.

Read MoreThe Advantage of Market Research for Your Business Plan

/Just like a comprehensive map reveals the lay of the land, market analysis provides a panoramic view of your competitive landscape. It's about gaining an edge over rivals, spotting opportunities for growth, and turning risks into actionable plans.

Read MoreWhy Personalized Business Plans are Key to SBA Loan Approval

/To secure an SBA loan, a generic, cookie-cutter business plan simply won't cut it. Lenders are looking for a clear, compelling vision for how entrepreneurs will use the loan funds to propel their growth.

This is where the power of a personalized business plan with Rapid Business Plans comes into play.

Read MoreNavigating SBA Financing: A Step-by-Step Guide to Business Plan Approval

/The path to securing an SBA loan involves a detailed application process, central to which is the submission of a comprehensive business plan.

Read MoreMaximizing Your SBA Loan Approval Odds: Essential Tips for Small Business Buyers

/As a small business owner, you know that the path to success is filled with both victories and challenges. One of the most significant obstacles many entrepreneurs face is…

Read MoreHow Rapid Business Plans Revolutionizes Planning for SMBs

/For many small and medium-sized businesses (SMBs), the traditional business plan has felt like a cumbersome brick, heavy with formalities and time-consuming to create. This often leads to procrastination, outdated plans, or worse…

Read MoreThis is what happened when I used AI to write a business plan

/ChatGPT doesn’t even think it should be writing business plans. I asked it for the top 10 reasons why not.

The Key Elements of a Business Plan for an SBA Loan

/Are you thinking of applying for an SBA loan? Before you do, make sure you have all the key elements of a business plan in order. It's not just about the numbers - it's also about the story behind your business and how it will succeed. Here are some tips to help make sure your business plan is ready for submission:

Know Your Market - Make sure you understand who your customers are and what their needs are. This will help you create an effective marketing strategy and ensure that your product or service meets their needs.

Set Goals - What do you want to achieve with this loan? Make sure to set realistic goals so that you can measure success and adjust as needed.

Financials - This is one of the most important parts of any business plan, so make sure to include accurate financial projections and plans for repayment.

Management Team - Showcase the experience and qualifications of your management team, as well as any outside advisors or consultants who may be helping with the project.

Unique Selling Point - What makes your business stand out from others in the same industry? Make sure to highlight this in your plan so that potential lenders can see why they should invest in you!

Writing a business plan can seem like a daunting task, but if done right it can be a great way to show potential lenders why they should invest in you and your business! Just remember to include all these key elements when writing yours, and don't forget to have some fun with it too!

Rapid Business Plans Honored as 7th Fastest Growing Florida State Alum Owned Small Business

/Rapid Business Plans, based in Jacksonville, FL, has been named as one of the fastest-growing companies owned or led by Florida State University alumni.

Rapid Business Plans was founded in 2015 by FSU alumnus Bethany McClellan (Biology, ’03), and since then has been providing custom-written business plans and feasibility studies for clients seeking SBA and USDA business loans. In 2017, the company was first recognized by Expertise.com as a top business consultant in Jacksonville, and has appeared on the list each year since then. The Rapid team has written over 1,000 business plans and reports that service the SBA and USDA small business government guaranteed lending industry.

“I am thrilled to be honored by FSU among the Seminole 100,” said Mrs. McClellan. “I share this honor with our world class team of 18 staff members who have worked tirelessly the last few years.”

Florida State University’s Seminole 100 is powered by the Jim Moran Institute of Entrepreneurship in partnership with the FSU Alumni Association. The top 100 fastest-growing FSU alumni-owned or alumni-led businesses are recognized at a celebration each year on FSU’s campus, during which each company learns their numerical ranking and receives their award. This event recognizes and honors FSU's entrepreneurs and allows them to share valuable business insights with each other.

“The alumni on the Seminole 100 list represent 12 schools and colleges across Florida State University and show the immense value of a degree from FSU,” said Julie Decker, president and CEO of the FSU Alumni Association. “The accomplishments of these alumni exemplify what is possible with tenacity and innovation. We are proud to recognize them for all they have achieved as leaders and entrepreneurs.”

The 2023 Seminole 100 includes companies from several industries such as construction, finance, legal, marketing and realty. Of this year’s 100 companies, 80 are based within the state of Florida and a total of 12 U.S. states are represented as part of the 2023 Seminole 100.

Writing Financial Projections for SBA Business Plans

/Why do I need financial projections with my business plan?

Why do I need financial projections with my business plan? There are many reasons a business owner may need financial projections. Perhaps your business is expanding, or you have not been in business more than 2 years. Another reason could be you haven’t been profitable in the last year or two. Any of these situations may require that your loan package is accompanied with financial projections or a full business plan.

There are several important items to include in the financial projections. Include projected profit and loss statements by month, not by year, balance sheet projections, cash flow projections, and written assumptions that tell how you arrived at those numbers. We use a program called Liveplan that gives a helpful outline and plug and play financial statements. You should also include the revenue you expect for your business and show this revenue by month.

Also include what you can charge. What pricing will the market bear for my industry? Start by calculating your capacity--with all the equipment and resources you will have, how many customers can you service in a month? How many clients do you actually expect the first month? Then how long will it take to ramp up to full capacity--or a percentage of capacity, like 75% or 85%? It is helpful to make these calculations in a spreadsheet.

Additionally, include your costs and expenses. How much does it actually cost to produce this product or service? For example, if you sell HVAC handlers, then what you pay to your manufacturer for the unit is a cost, and the labor to install it is also a cost. Employees that are directly associated with providing the product or service you sell are direct labor. Expenses are also called overhead. What are the expenses to keep your lights on? This can be other, non-direct labor, your utilities, phone bill, rent, software, dues and subscriptions, marketing, and other expenses that may be industry specific. If you are buying a building, don’t forget to include property taxes.

If you are securing a loan, it’s important to include those numbers in your cash flow calculation. If using Liveplan (our preferred business plan software), please see the Financing section on the Forecasting tab. Don’t forget to include a written blurb in the narrative describing the size of the loan and any payback terms you may already know.

Another item to include is written assumptions. Part of your business plan should have a section that is a written narrative describing how you arrived at your calculations. I have included a sample written assumptions section that can guide you

This sample comes from an after-school athletics business plan:

[start sample] Revenue

Revenue is derived from two different sources - monthly memberships and group coaching classes. The monthly membership pricing can be one of three tiers as listed below:

Bronze $75 per month 1-30 minute shooting session per week.

Silver $150 per month 3- 30 minute sessions per week.

Platinum $250 per month. 3- 1hour sessions or 6 - 30 minute sessions.

With this loan, 904 Hoops will be able to expand from one lane available for memberships to first 3 lanes, then 5 lanes total increasing capacity. Capacity per lane, is estimated to be 12 silver memberships per month that we anticipate being the typical membership choice. There are currently 10 monthly members, as we just opened in October 2020. The financial projections on the following pages show a gradual ramp up from those 10 members to our expected 40 by the end of 2021, then hovering around capacity by mid-2022 and thereafter.

Group coaching will initially be 2 cohorts of up to 10 students each and will be $150 per month per student for 4 group sessions monthly. One will be taught by owner Ray, and another will be taught by a guest trainer. There is an expected ramp up, but after year one, we expect these classes to be very popular and at capacity for the remainder of the 3 years contemplated by this business plan.

Costs

Direct costs include only the guest trainer, and that is a revenue split between owner and the trainer wherein the owner receives 60% of the class revenue and the trainer receives 40%.

Expenses

Regular expenses include:

Rent - $2,100 to be paid until lease ends in September 2021

Cable/Phone $100/mo

Alarm - $100/mo security and cameras

Electric - Much less at existing rental location, increasing due to new air-conditioned facility opening Oct 2021.

Insurance - $800/yr

So you want to start a franchise? Here's how to pay for it.

/When researching lenders, it’s important to consider the pros and cons of your options.

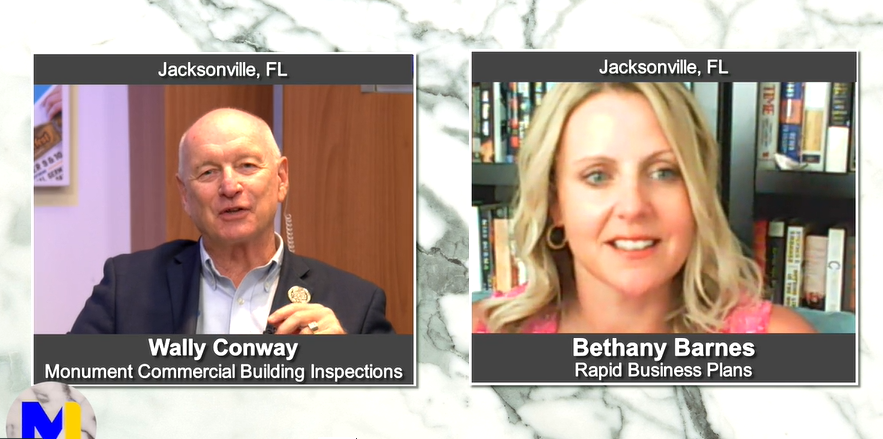

Read MoreVideo: Tips on Business Plans for SBA Loans

/Being prepared with a business plan when seeking an SBA loan can make your process so much easier.

Read MoreRapid Business Plans Named Best Consultant in Jacksonville 4th Year in a Row!→

/Rapid Business Plans, formerly Prior Business Consulting, is named a top consultant in Jacksonville for the 4th year in a row. The accolade goes to consultants deemed to have the best reputation, credibility, experience, availability and professionalism.

Read MoreIs Your Small Business Recession Proof? Guest blog for Supporting Strategies

/Recession-Proof Business Planning

Factfulness: Gaining a Better (and More Hopeful) Perspective of Today's World

/In 2019, a step back to look at what’s happening is daunting - from dozens of mass shootings to economic uncertainty, volatile foreign powers, cyber-threats, questionable privacy, rapidly evolving technologies, cultural dissent, and more, a sense of being scared and overwhelmed seems reasonable. But are things as bad as they seem? Swedish statistician Hans Rosling and his son Ola Rosling in their 2018 book, Factfulness, take a step back from the fray to analyze trends and data to see whether our lives are getting worse or better, and show that in the grand scheme perhaps things are better and more hopeful than mass-media-fueled majority majority of everyday people might realize.

Factfulness is about understanding how our instincts program us to exaggerate situations and distort our perception of reality in ways that further exacerbate problems and how we react to them. In his book, Rosling outlines ten of these fundamental instincts and how to combat them to cultivate shift towards a perception based in fact that will ultimately alter the way we think, feel, and behave as a result.

Here’s a summary of some key insights and lessons for building a more “factful” perspective:

Read More

A strong economy can mask underlying problems at a small business. When the next recession hits — and historically speaking, it's

A strong economy can mask underlying problems at a small business. When the next recession hits — and historically speaking, it's